PARS-CCLC Pension Rate Stabilization Program (PRSP)

A Comprehensive Prefunding Solution to Address Rising STRS/PERS Costs

PARS (Public Agency Retirement Services), in partnership with the Community College League of California (CCLC), is proud to offer the Pension Rate Stabilization Program (PRSP), a first-of-its-kind, IRS-approved, IRC Section 115 irrevocable trust program designed to help community college districts manage ongoing pension obligations.

Program Benefits

- Stabilize Costs: Access funds to reimburse your District for pension-related expenses to help offset rising STRS/PERS contribution rates

- Local Control: District maintains autonomy over assets, contributions, disbursements, timing and investment risk tolerance

- Protection: Funds in the trust are securely set-aside and protected from diversion for uses other than pension

- Diversified Investing: Assets in an exclusive benefit trust can be diversely invested and may achieve greater returns than your general fund/treasury pool

- Rainy Day Fund: Emergency source of funds when employer revenues are strained in difficult budgetary or economic times

- Long-Term Planning: Prudent solution for managing ongoing pension liabilities on financial statements due to GASB 68

Key Advantages of PRSP

- Turn-Key: A simple governance trust structure and full service approach reduces staff and fiduciary burdens

- U.S. Bank: Security of the 5th largest commercial bank and one of the nation’s largest trustees for Section 115 trusts

- Program Pioneer: PARS pioneered the pension prefunding trust in 2015, receiving a first-of-its-kind IRS private letter ruling

- Low-Cost Approach: Economies of scale without risk sharing, low-cost investments, and fees that decrease as assets grow across investment pools

- Investment Flexibility: *PFM Asset Management offers active and index investment strategies at a variety of risk tolerance levels.

- Personalized Service: PARS and Community College League provide a dedicated and experienced team to serve your ongoing needs

*PFM Asset Management LLC ("PFMAM") is a third-party investment adviser registered with the U.S. Securities and Exchange Commission and a subsidiary of U.S. Bancorp Asset Management, Inc.

Districts Facing Ongoing STRS and PERS Increases

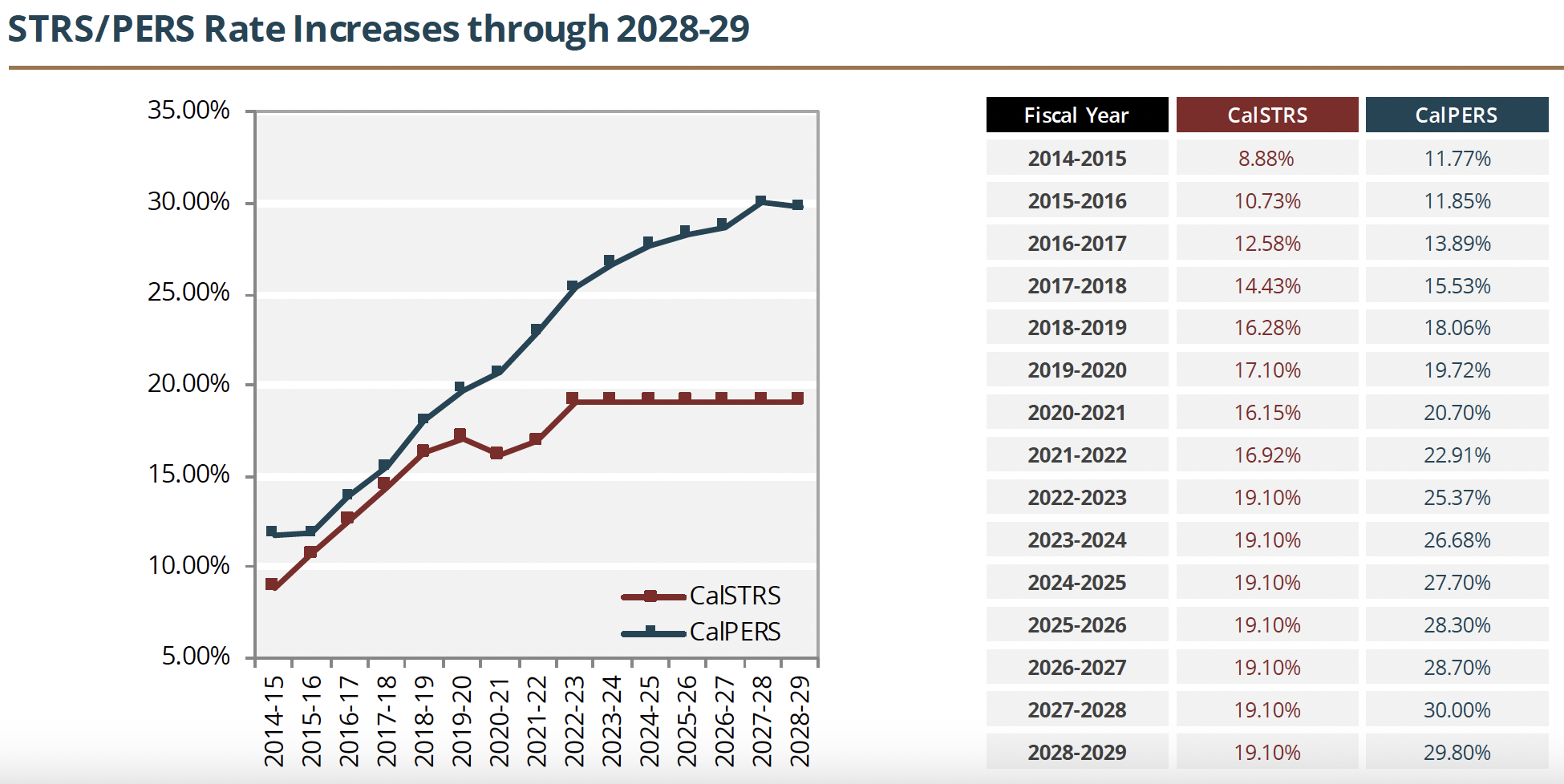

California community college districts face scheduled increases to their STRS and PERS contribution rates through 2028-29 due to the underfunding of the pension plans. The Chancellor’s Office has recommended that districts plan ahead for long-term ongoing liabilities by setting funds aside now.

STRS/PERS Contribution Rate Increases Through 2028-29

About PARS

For over 40 years, PARS has been a leader in custom and turn-key retirement programs for community colleges and other public agencies. PARS pioneered the PRSP concept and obtained a first-of-its-kind Private Letter Ruling from the IRS in 2015. Since then, over 300 public agencies in California have joined PRSP including colleges, school districts, cities, counties and special districts. As a specialist in retirement program design, implementation and ongoing administration, PARS has administered more than 2,000 plans for over 1,000 clients and 700,000 public employees, cumulatively saving hundreds of millions of dollars in public resources.

Contacts

PARS (Public Agency Retirement Services)

(800) 540-6369

- Eric O’Leary, ext. 124 | eoleary@pars.org

- Rachael Sanders, ext. 121 | rsanders@pars.org

- Jennifer Meza, ext. 141 | jmeza@pars.org

League Staff

- Lisa Mealoy, 916-245-5027 | lmealoy@ccleague.org